Forms

-

Request to Remove Homeowner’s Exemption (Russian Version - ОТКАЗ ОТ НАЛОГОВОЙ ЛЬГОТЫ ДЛЯ ДОМОВЛАДЕЛЬЦЕВ)

If the property is receiving the Homeowners’ Exemption, but the property owner has moved, it is the property owner’s responsibility to notify the Assessor to remove the exemption.

-

Request to Remove Homeowner’s Exemption (Spanish Version - Solicitud para eliminar la exención de propietario)

If the property is receiving the Homeowners’ Exemption, but the property owner has moved, it is the property owner’s responsibility to notify the Assessor to remove the exemption.

-

Request to Remove Homeowner’s Exemption (Tagalog Version - Kahilingang Alisin Ang Homeowners’s Exemption Ng May-ari Ng Bahay Na Kanyang Tinitirahan)

If the property is receiving the Homeowners’ Exemption, but the property owner has moved, it is the property owner’s responsibility to notify the Assessor to remove the exemption.

-

Residential Construction Project Information Form (Sample)

Each year the Assessor-Recorder is required by the State of California to value all in-progress new construction. We mail a letter to property owners that have an open permit for new construction as of January 1. This form is for you to tell us what the status of your project is and how much has been completed.

-

Residential Construction Project Information Form, Chinese Version

Each year the Assessor-Recorder is required by the State of California to value all in-progress new construction. We mail a letter to property owners that have an open permit for new construction as of January 1. This form is for you to tell us what the status of your project is and how much has been completed.

-

Residential Construction Project Information Form, Filipino Version

Each year the Assessor-Recorder is required by the State of California to value all in-progress new construction. We mail a letter to property owners that have an open permit for new construction as of January 1. This form is for you to tell us what the status of your project is and how much has been completed.

-

Residential Construction Project Information Form, Spanish Version

Each year the Assessor-Recorder is required by the State of California to value all in-progress new construction. We mail a letter to property owners that have an open permit for new construction as of January 1. This form is for you to tell us what the status of your project is and how much has been completed.

-

Residential Property Assessment Appeals Publication 30, Chinese Version

Pub 30The property taxes you pay are based on your property’s assessed value, as determined by the Assessor-Recorder’s office.

-

Residential Property Assessment Appeals Publication 30, English Version

The property taxes you pay are based on your property’s assessed value, as determined by the Assessor-Recorder’s office.

-

Residential Property Assessment Appeals Publication 30, Spanish Version

Pub 30The property taxes you pay are based on your property’s assessed value, as determined by the Assessor-Recorder’s office.

-

Restrictive Covenant Modification Form

Recordation of this document allows owners to strike out blatant racial, religious, or otherwise unlawfully restrictive covenants from a previously recorded document after the City Attorney's Office determines such language violates the fair housing laws and is void.

-

Restrictive Covenant Modification Program Implementation Plan

Pursuant to the 2021 legislation set forth in Assembly Bill AB-1466 and the California Government Code Section 12956.3, the San Francisco Assessor-Recorder’s Office (ASR) has developed a plan to identity documents in its Official Record containing unlawful covenants in violation of GC Section 12955(l) and to rerecord them with the restrictive language redacted through its Restrictive Covenant...

-

RP Taxpayer Help Pages

This user guide provides detailed instructions on how to navigate our Community Portal from submitting customer service requests to filing exemption forms and/or responding to information requests.

-

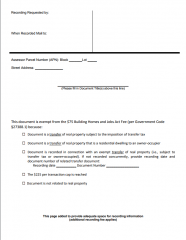

SB2 Exemption Recording Coversheet

The California Legislature passed SB2 (Atkins) on September 29, 2017, stipulating that effective January 1, 2018, certain recordable documents will be charged an additional fee to support the Building Homes & Jobs Act.

-

Seismic/Solar Transfer Tax Exemption (Prop N)

A partial exemption shall only apply to the initial transfer by the person who installed the active solar system or made the seismic safety improvements. The amount of this partial exemption shall not exceed the transferor’s cost of seismic retrofitting improvements or the active solar system. Multi-family residential properties are eligible for this partial exemption.