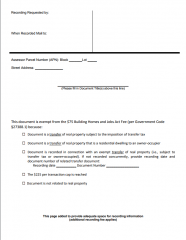

SB2 Exemption Recording Coversheet

The California Legislature passed SB2 (Atkins) on September 29, 2017, stipulating that effective January 1, 2018, certain recordable documents will be charged an additional fee to support the Building Homes & Jobs Act.

This change requires County Recorders throughout California to charge an additional $75 fee at the time of recording every real estate instrument, paper, or notice required or permitted by law to be recorded, except those expressly exempted from payment of recording fees.

A declaration of exemption specifying the reason for the exemption from the fee must be placed on the face of each document, or on a coversheet to be recorded with the document, prior to submitting to the Recorder. This sample SB2 Exemption Coversheet can be used for claimed exemptions from the $75 SB2 fee. Declarations of exemption are subject to review.

Last updated: 4/18/18