Forms

-

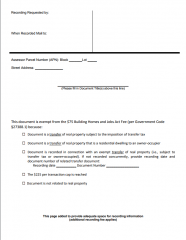

SB2 Exemption Recording Coversheet

The California Legislature passed SB2 (Atkins) on September 29, 2017, stipulating that effective January 1, 2018, certain recordable documents will be charged an additional fee to support the Building Homes & Jobs Act.

-

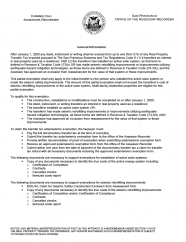

Seismic/Solar Transfer Tax Exemption (Prop N)

A partial exemption shall only apply to the initial transfer by the person who installed the active solar system or made the seismic safety improvements. The amount of this partial exemption shall not exceed the transferor’s cost of seismic retrofitting improvements or the active solar system. Multi-family residential properties are eligible for this partial exemption.

-

Summary Leased Equipment Schedule

The Summary Leased Equipment Schedule is one of two (2) templates provided by the Business Property Division of the Office of the Assessor-Recorder to assist lessors report equipment out on lease in the City and County of San Francisco.

-

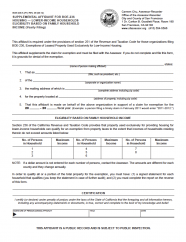

Supplemental Affidavit for BOE-236, Housing – Lower-Income Households

BOE-236-ASection 236 of the California Revenue and Taxation Code provides that property used exclusively for providing housing for lower-income households can qualify for an exemption from property taxes.