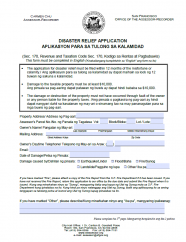

Disaster Relief Application (Tagalog - Aplikasyon Para Sa Tulong Sa Kalamidad)

Typical misfortunes or calamities which may qualify for reduced assessment include fire, flood, or earthquake damage. Damage to personal property, such as household furnishings, is not eligible since it is not assessed for property tax purposes. Other personal property such as boats and airplanes that are assessed do qualify.

Requirements:

• $10,000 or more in property damage

• Not the fault of the property owner or the party responsible for the taxes eligible

• Within twelve months of the date of the disaster, the assessee or party responsible for the taxes must submit an application for reduced assessment

This program requires reassessment of the property to reflect its damaged condition, and the subsequent reduction or partial refund of the current year's taxes. After the property is fully repaired, owners will retain their previous base year value if the property is rebuilt in a like or similar manner. Property suffering a gradual deterioration over a long period of time does not qualify.

Please note that if you are applying for disaster tax relief due to a fire, you will be asked to attach a copy of the Fire Report from the S.F. Fire Department to your application. However, if the S.F. Fire Department has not issued the Fire Report by the time this application is due (within 12 months of the misfortune or calamity), do not wait for the Fire Report to submit your application. Return the application to our office by the due date and submit the Fire Report when it is issued.

Submission Deadline: Within 12 months of the misfortune or calamity.

Last updated: 3/22/21