Forms

-

Preliminary Change of Ownership Report

BOE-502AState law requires the property owner of real property to file a Preliminary Change of Ownership Report when recording certain documents. If this form is not filed, a $20 fee must be charged at the time of recording. The information provided on this document is confidential and is not subject to public inspection.

-

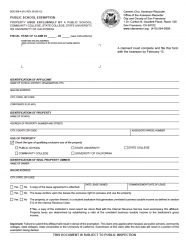

Public School Exemption

BOE-268-ABuildings, land, equipment that is being used exclusively for public schools, community college, state college, state university, or University of California may qualify for the public school exemption.

-

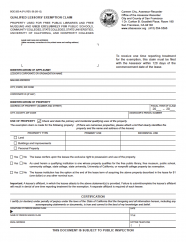

Qualified Lessors’ Exemption

BOE-263-AThe Lessor’s Exemption is available to property that is leased, as of the lien date, January 1, for the very specific uses.

-

Recorded Document Request by Mail

A request for a copy of a recorded document can be mailed to the Assessor-Recorder’s Office.

-

Recorder Division Fee Schedule

San Francisco County Recorder Division Fee Schedule (Effective May 12, 2024)

-

Reduction of Deficiency Assessed for Rent-Restricted Affordable Housing Projects

Under a new local law passed on December 15, 2023, transfers of qualified rent-restricted affordable housing that occurred between January 1, 2017, but prior to July 1, 2024, may be eligible for a partial refund of taxes paid or a reduction of a deficiency assessed if the taxpayer submits a refund request by December 31, 2024.

-

Refund of Transfer Taxes Paid for Rent-Restricted Affordable Housing Projects

Under a new local law passed on December 15, 2023, transfers of qualified rent-restricted affordable housing that occurred between January 1, 2017, but prior to July 1, 2024, may be eligible for a partial refund of taxes paid or a reduction of a deficiency assessed if the taxpayer submits a refund request by December 31, 2024.

-

Religious Exemption Change in Eligibility or Termination Notice

BOE 267SNTVerification - property to which the exemption applies towards the following fiscal year continue to be used exclusively for religious purposes.

-

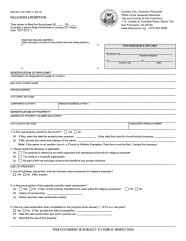

Religious Exemption Claim

BOE-267-SThe exemption applies to property used for worship, fellowship, religious counseling, offices, parking, and school grades 12 and under.

-

Report of Tenants

The Report of Tenants is to fulfill our duty of identifying assessable personal property as required by the Revenue and Taxation Code, which is done annually.

As part of our efforts to streamline our processes and avoid unintended errors, we strongly encourage you to complete the Report of Tenants (item #1) in an EXCEL format through our website.

We ask that you email all the...

-

Request for Business Account Closure

Complete and return this form to the Office of the Assessor-Recorder to request closure of an existing business personal property account. If you are closing your business, please note that you must also notify the Office of the Treasurer and Tax Collector of your business closure.

-

Request for Changes to Business Personal Property Account

Business owners are required to inform the Assessor-Recorder, Business Personal Property Division, of any changes to their business accounts, such as, changes to location, ownership, or mailing address. This form can be completed and submitted to our office by the account owner or an authorized agent.]

-

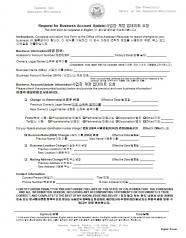

Request for Changes to Business Personal Property Account ( Korean -- 사업장 계정 업데이트 요청)

Business owners are required to inform the Assessor-Recorder, Business Personal Property Division, of any changes to their business accounts, such as, changes to location, ownership, or mailing address. This form can be completed and submitted to our office by the account owner or an authorized agent.

-

Request for Changes to Business Personal Property Account ( Russian -- Запрос на обновление коммерческой информации)

Business owners are required to inform the Assessor-Recorder, Business Personal Property Division, of any changes to their business accounts, such as, changes to location, ownership, or mailing address. This form can be completed and submitted to our office by the account owner or an authorized agent.

-

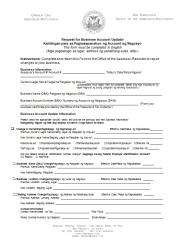

Request for Changes to Business Personal Property Account ( Tagalog - Kahilingan para sa Pagsasapanahon ng Account ng Negosyo)

Business owners are required to inform the Assessor-Recorder, Business Personal Property Division, of any changes to their business accounts, such as, changes to location, ownership, or mailing address. This form can be completed and submitted to our office by the account owner or an authorized agent.