Forms

-

Community Resource Guide (Chinese - 資源指南)

當您繼續與親朋好友重新聯繫時候,估值官辦公室致力於繼續幫助三藩市居民保持健康和繁榮。因此估值官辦公室製作了這份指南和大家分享一些非常重要的社區資源和消息。

-

Community Resource Guide (English)

The Office of the Assessor-Recorder is committed to help San Franciscans achieve health and well-being as you continue to reconnect with your loved ones, neighbors, and our great city. That's why this resource guide was created to share community resources and information important to you.

-

Community Resource Guide (Spanish - guía de recursos)

La Oficina del Asesor-Registrador está comprometida a ayudar a los residentes de San Francisco a lograr la salud y el bienestar a medida que continúa reconectándose con sus seres queridos, vecinos y nuestra gran ciudad. Es por eso que esta guía de recursos se creó para compartir recursos de la comunidad e información importante para usted.

-

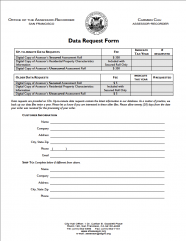

Data Request Form – Unsecured & Secured Roll Data

You can request data either by downloading this form and mailing it in, or emailing our office.

-

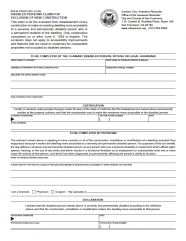

Disabled Persons Claim for Exclusion of New Construction and Certificate of Disability

BOE-63Only construction completed on or after June 6, 1990 is eligible. The exclusion does not apply to accessibility improvements and features that are usual or customary for comparable properties not occupied by disabled persons.

-

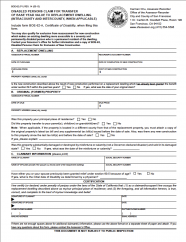

Disabled Persons Claim for Transfer of Base-Year Value to Replacement Dwelling

BOE-62Use this form if both the sale of the original primary residence and the purchase or new construction of the replacement primary residence occurred before April 1, 2021. For base year value transfers under Proposition 19, please use Claim for Transfer of Base Year Value to Replacement Primary Residence for Severely Disabled Persons (BOE‐19‐D).

-

Disabled Veterans' Tax Exemption Change of Eligibility Report

BOE-261GNTThis form allows for a property exemption for the home of a veteran, or the home of the unmarried surviving spouse of a veteran, who has incurred an injury or disease during military service, is blind in both eyes, has lost the use of two or more limbs, or is totally disabled.

-

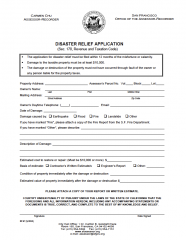

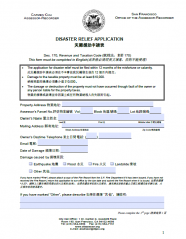

Disaster Relief Application

Typical misfortunes or calamities which may qualify for reduced assessment include fire, flood, or earthquake damage. Damage to personal property, such as household furnishings, is not eligible since it is not assessed for property tax purposes.

-

Disaster Relief Application ( Chinese - 災難援助申請表)

Typical misfortunes or calamities which may qualify for reduced assessment include fire, flood, or earthquake damage. Damage to personal property, such as household furnishings, is not eligible since it is not assessed for property tax purposes.

-

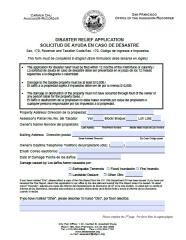

Disaster Relief Application (Spanish - Solicitud de ayuda en caso de desastre)

Typical misfortunes or calamities which may qualify for reduced assessment include fire, flood, or earthquake damage. Damage to personal property, such as household furnishings, is not eligible since it is not assessed for property tax purposes.

-

Disaster Relief Application (Tagalog - Aplikasyon Para Sa Tulong Sa Kalamidad)

Typical misfortunes or calamities which may qualify for reduced assessment include fire, flood, or earthquake damage. Damage to personal property, such as household furnishings, is not eligible since it is not assessed for property tax purposes.

-

Elderly or Handicapped Families Family Household Income Reporting Worksheet

BOE-267-HAWorksheet provided to each family living on property. To accompany claim seeking exemption on housing for elderly or handicapped families that is owned and operated by a nonprofit organization.

-

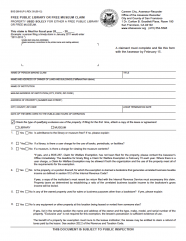

Exemption for Property Used by a Free Public Library or Free Museum

BOE-268-BProperty, whether owned or leased, which as of the lien date (January 1), is used for libraries and museums that are free and open to the public.

-

Exemption of Leased Property Used Exclusively for Low-Income Housing

BOE-236Leased property used for low-income housing may be exempt.

-

Homeowners’ Exemption Claim Form, English Version

BOE-266If you own a home and occupy it as your principal place of residence on January 1, you may apply for an exemption of $7,000 from the home’s assessed value, which reduces your property tax bill.

Submission Deadline: February 15 or before the 30th day following the date of notice of supplemental assessment, whichever comes first.