Forms

-

Welfare Exemption Supplemental Affidavit, Housing - Elderly or Handicapped Families

BOE-267-HAn affidavit required when seeking exemption on housing for elderly or handicapped families that is owned and operated by a nonprofit organization.

-

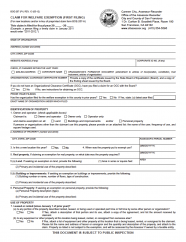

Welfare Exemption Supplemental Affidavit, Housing-Lower Income Households

BOE-267-LAn affidavit required when seeking exemption for low-income housing that is owned and operated by a nonprofit organization.

-

Welfare Exemption Supplemental Affidavit, Low-Income Housing Property of Limited Partnership

BOE-267-L1An affidavit required when seeking exemption for low-income housing that is owned and operated by a limited partnership.

-

Welfare Exemption Supplemental Affidavit, Organizations and Persons Using Claimant's Real Property

BOE-267-OFILING OF AFFIDAVIT:

-

Welfare Exemption Supplemental Affidavit, Rehabilitation - Living Quarters

BOE-267-RAn affidavit required when seeking exemption on property that involves rehabilitation of persons and/or living quarters.

-

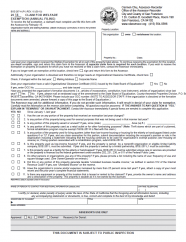

Welfare Exemption, Annual Filing

BOE-267-AThe welfare exemption is available for real and personal property owned and used exclusively by non-profit organizations formed for religious, scientific, hospital or charitable purposes.

-

Welfare Exemption, First Filing

The welfare exemption is available for real and personal property owned and used exclusively by non-profit organizations formed for religious, scientific, hospital or charitable purposes.

Form Number: BOE-267

Submission Deadline: February 15

(Example: a claimant filing a timely claim in January 2021 would enter "2021-2022.")